Once that is done, a rolling financial forecast is then done monthly to adjust as time moves on, more information becomes available, and circumstances change. A firm will often go through a formal budgeting process near the end of its calendar or fiscal year to project financial plans and goals for the coming year. A one-year forecast, broken down by month, is quite typical. The length generally depends on the user’s needs. Length of a Forecastįorecasts can generally be for any length of time.

#Statement of cash flows proforma pro

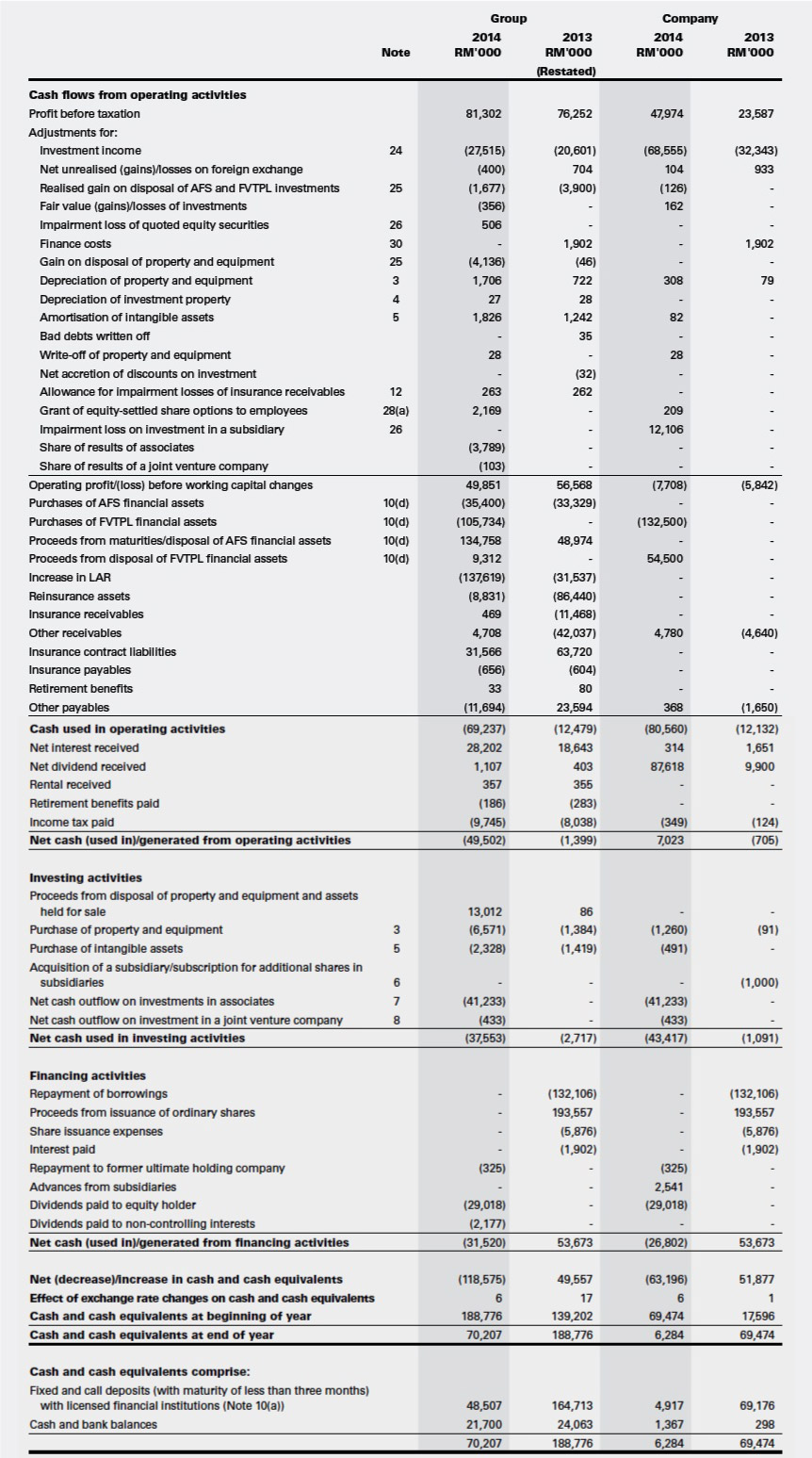

Review the video Business Plan and Pro-Forma Financial Statements to learn about the basics of pro forma financial statements and why they are helpful. Managers can forecast cash flow using data from forecasted financial statements this allows them to identify potential gaps in cash and plan ahead in order to either alter collection and payment policies or obtain funding to cover the gap in the timing of cash flows. Forecasting helps assess both cash flow and the profitability of future growth. The firm may make a profit, but if it doesn’t manage the timing of its cash flows, it could be forced to shut down if it can’t cover the costs of payroll or keep the lights on. The same is true of profitable sales that don’t generate enough cash flows at the right time. A larger top-line sales figure that results in lower net income doesn’t make sense in the grand scheme of things. Growing just for the sake of growing doesn’t always yield favorable income for the firm. In this realm, the key purpose of pro forma (future-looking) financial statements is to manage a firm’s cash flow and assess the overall value that the firm is generating through future sales growth. Our focus here, however, is the world of finance. Purpose of a ForecastĪs mentioned earlier in the chapter, forecasts serve different purposes depending on who is using them. We’ll look at why we use them, how long they generally are, what the key variables in a forecast are, and how we pair those variables with common-size analysis to develop the forecast. In this section of the chapter, we will move beyond the sales forecast and look at the general nature, length, and timeline of forecasts and the risks associated with using them. Explain the risks associated with a financial forecast.Describe the factors that impact the length of a financial forecast.Define pro forma in the context of a financial forecast.

By the end of this section, you will be able to:

0 kommentar(er)

0 kommentar(er)